Redeemable preference shares to be treated as debt in certain circumstances1

June 06, 2023 | 3 comments

The International Financial Services Authority (‘IFSCA’) has issued a circular prescribing reporting

requirements for fund

management entities (‘FMEs’) registered under the IFSCA (Fund Management) Regulations, 2022 (‘IFMR’)

This alert provides a brief snapshot of the reporting requirements prescribed by the IFSCA for FMEs

1. The FMEs are required to make half yearly reporting to IFSCA in the prescribed format.

2. The reporting prescribed by IFSCA include provision of:

a. Quantitative information about the fund management operations of the FMEs which is to be

submitted in the

editable excel format – click here for the format

b. A duly signed ‘compliance report’ to be submitted in .pdf format – click here for the format

3. Submission dates:

a. First report for the period October 1, 2022, to March 31, 2023, to be submitted by FMEs by June

21, 2023.

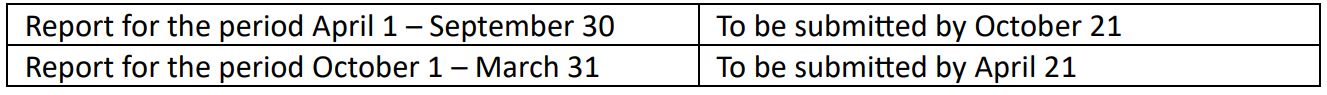

b. Subsequent reports shall be submitted within 21 calendar days of the end of the half-year. Thus,

4. The reports are to be submitted to IFSCA via mail at FME-reporting@ifsca.gov.in

1 May 31, 2023

SAT ruling to aid appointment of independent directors

The Securities Appellate Tribunal (SAT) has ruled against the Securities and Exchange Board of India (Sebi) and NSE in a recent matter that pertains to the appointment of an independent director (ID) by Nectar Life Sciences.

CONTINUE READING

June 06, 2023 | 3 comments

SEBI Consulting papers for the Alternative Investment Funds (‘AIFs’) and Foreign Venture Capital Investors (‘FVCIs’)

The Securities and Exchange Board of India (‘SEBI’) has issued new series of consulting papers for the alternative investment funds (‘AIFs’) and foreign venture capital investors (‘FVCIs’) on May 18, 2023 and May 23, 2023.

CONTINUE READING

June 06, 2019 | 3 comments

Compulsorily convertible debentures (‘CCD’) may not be treated as financial debt but the unpaid interest on CCDs is to be treated as financial debt for the purpose of insolvency

In a recent ruling, the Hon’ble National Company Law Tribunal (‘NCLT’) evaluated as to whether the principal amount compulsorily convertible debentures (‘CCDs’) and / or the interest thereon constitute financial debt as per the provisions of the Invsolvency and Bankruptcy Code, 2015 (‘IBC’)

CONTINUE READING

July 3, 2019 | 3 comments