SEBI Consulting papers for the Alternative Investment Funds (‘AIFs’) and Foreign Venture Capital Investors (‘FVCIs’)

June 06, 2023 | 3 comments

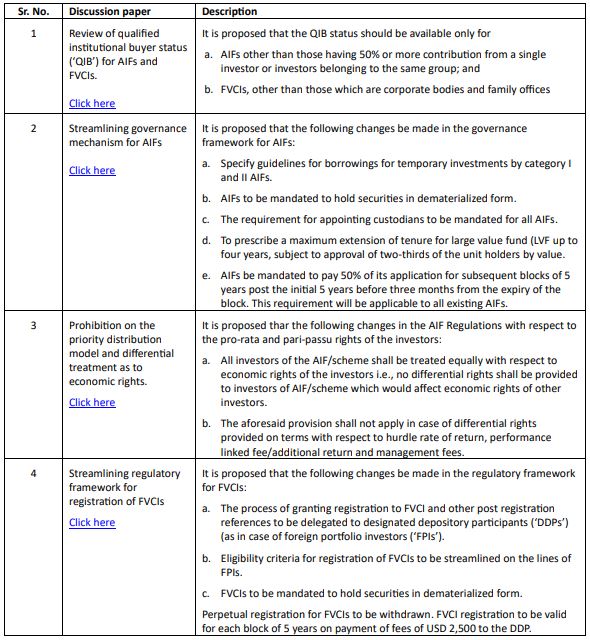

The Securities and Exchange Board of India (‘SEBI’) has issued new series of

consulting papers for the alternative investment funds (‘AIFs’) and foreign venture capital

investors (‘FVCIs’) on May 18, 2023 and May 23, 2023.

This alert provides a brief snapshot of the propositions by the SEBI through the consulting papers

Our comments:

These are the second series of consulting papers issued by the SEBI reforming the AIF regulatory

framework in January and

February this year.

The series of the consulting papers and the amendments points towards a comprehensive review and

reform of the AIF

Regulation by SEBI on each of the key aspects the industry has been dealing and discussing over some

of the past years. It

appears that SEBI has been keeping a close eye on the market practices and the disclosures made by

the AIFs as well as

analysing the data / information available at their end for deciding on the future course of reforms

for the AIF industry.\

The proposed suggestions for AIFs in relation to licencing requirements, re-aligning the requirement

of extension of tenure,

mandatory dematerialization, guidelines for borrowings by AIFs provide towards the continuous

monitoring and reforming the

AIFs regulations. The proposed amendment to clarify on the pro-rata economic rights of the investors

to mitigate regulatory

arbitrage and systemic risks points out towards the close eye of the SEBI on the functioning and

needs of the AIF industry.\

The discussion papers also highlight extensive deliberations of the proposals with the APAC as well

as working groups being

set-up for critical aspects for making recommendations as well as intensive research and

deliberations within SEBI before

releasing the proposals for public comments.

The proposed suggestions for the FVCIs are also a welcome move given the long term overdue at the

re-visit to the FVCI

Regulations. We expect more discussions and deliberations on the FVCI regime in the near future