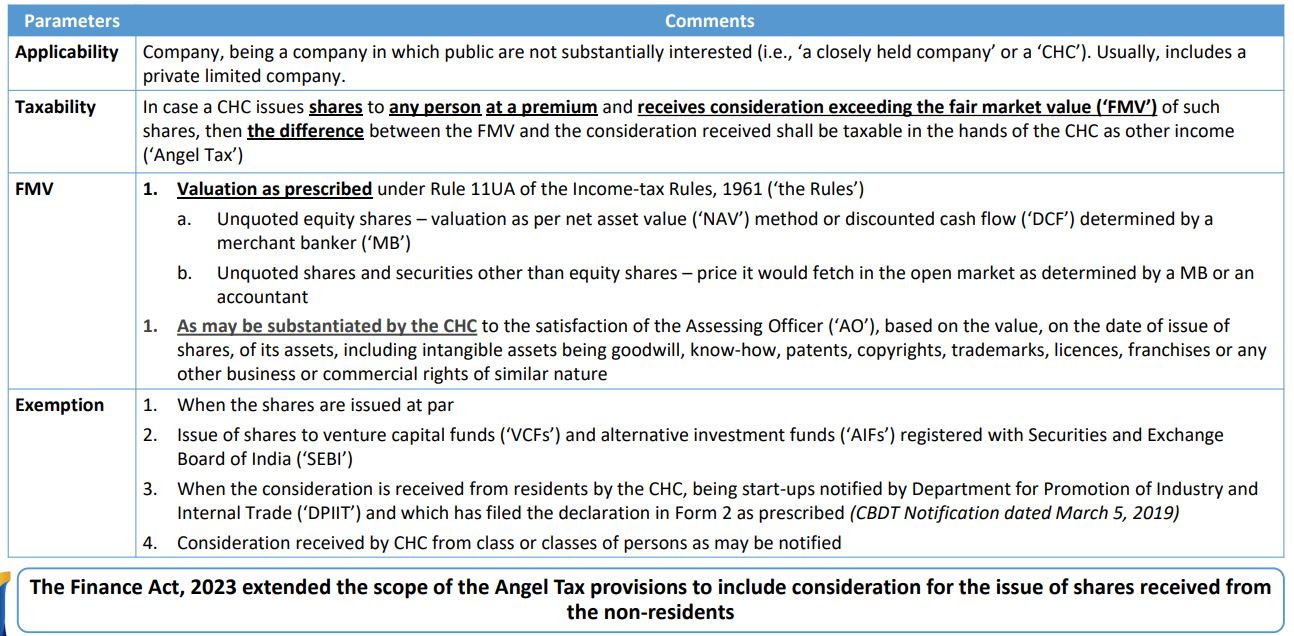

Angel tax provisions upto the Finance Act, 2023

June 06, 2023 | 3 comments

Pursuant to the interaction with various stakeholders, the Ministry of Finance /

CBDT decided to make amendments to the Angel Tax Provisions and Rule 11UA

Section 56(2)(viib) of the Income-tax Act, 1961 (‘the Act’)

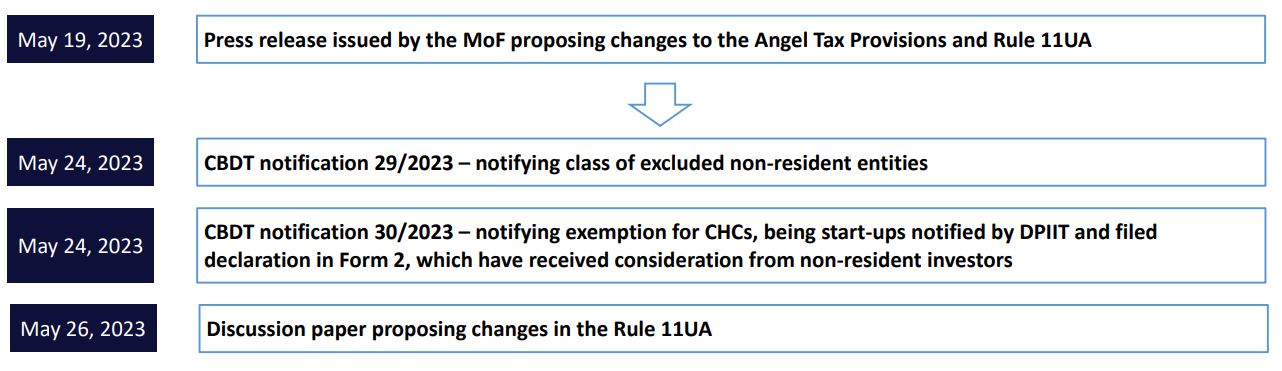

Recent amendments

Pursuant to the interaction with various stakeholders, the Ministry of Finance / CBDT decided to make amendments to the Angel Tax Provisions and Rule 11UA

Towards this, the MoF / CBDT issued the following press release, discussion paper and notifications.

Press release dated May 19, 2023

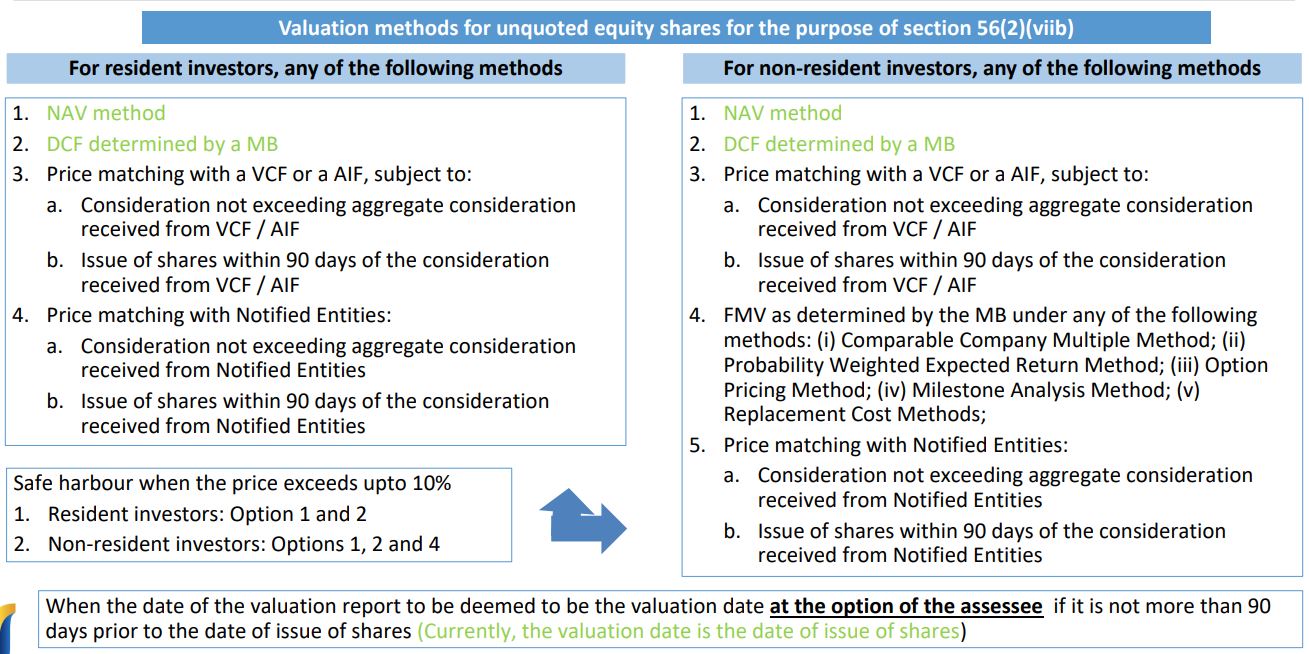

A. Proposed changes in the valuation norms

1. Additional valuation methods: Additional five valuation methods for valuation of shares to be prescribed for non-resident investors.

2. Price matching: Price at which the equity shares are issued by CHC to non-resident entity notified by the Central Government

(‘Notified Entity’) may be taken as the FMV of the equity shares of resident and non-resident investors subject to following:

a. The consideration at such FMV does not exceed the aggregate consideration that is received from the notified entity; and

b. The consideration has been received by the CHC from the Notified Entity within a period of ninety days of the date of issue of shares which are the subject matter of valuation.

3. Price matching shall be available for resident and non-resident investors with reference VCFs and AIFs as well.

4. Safe harbour provisions: Safe harbour of 10% variation in value is provided for fluctuations in valuation on unquoted equity shares

5. Expiry date of valuation report of MB: 90 days from the date of the issue

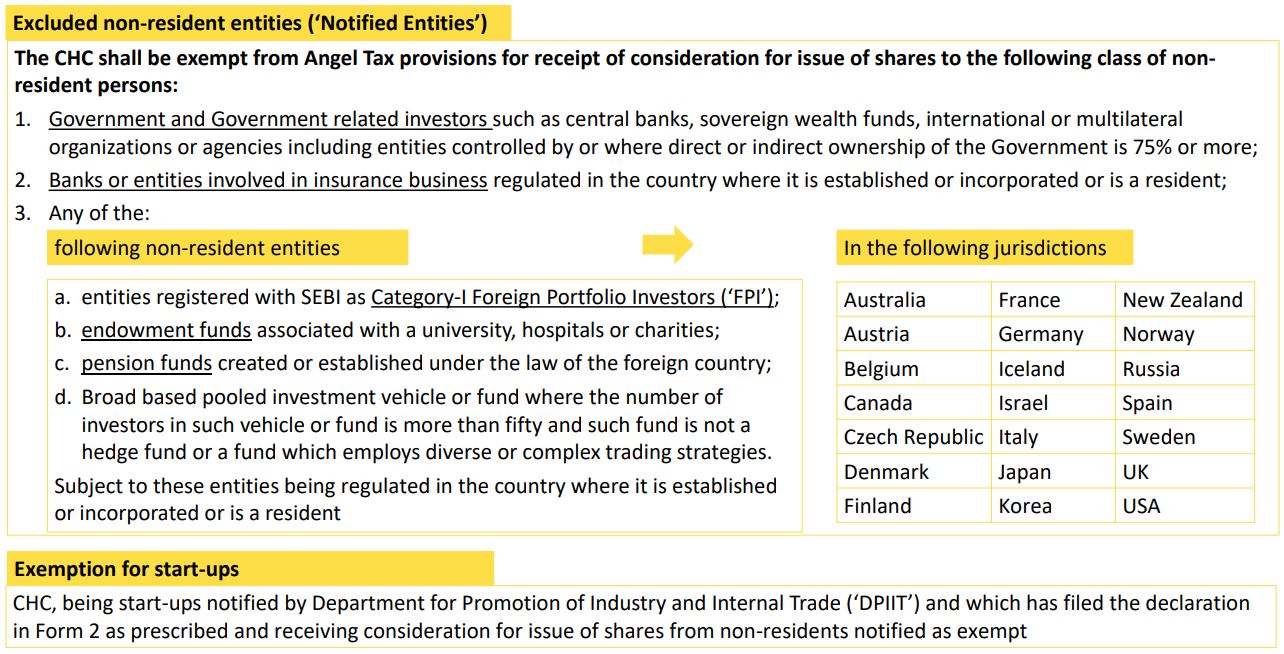

B. Proposed changes in the Angel Tax provisions – Exemption for receipt of consideration from non-resident investors

1. Excluded entities: Certain class of non-resident investors as mentioned below are proposed to be exempted from the Angel Tax provisions

a. Category I foreign portfolio investor (‘FPI’);

b. Endowment funds associated with universities or hospitals or charities;

c. Pension funds;

d. Broad based pooled investment vehicle or fund where the number of investors in such vehicle or fund is more than fifty and such fund is not a hedge fund or a fund which employs diverse or complex trading strategies.

2. Exemption for start-ups: Exemption for start-ups notified by DPIIT for receiving consideration from non-resident investors

CBDT notifications on May 24, 2023

Discussion paper dated May 26, 2023 [For replacing existing Rule 11UA]

Our comments

1. Exemption for Start-ups which are registered with DPIIT and have filed the declaration in Form 2 as prescribed exempt from Angel Tax provisions in case of issue of shares to non-resident investors

2. Valuation norms prescribed only for unquoted equity shares:

a. For preference shares (including compulsorily convertible preference shares (‘CCPS’))], price fetched in the open market as determined by MB or an accountant to be considered

b. However, usually, CCPS are issued at par – hence there may not be much impact of these exclusions

3. Notified Entities:

a. Key foreign investment jurisdictions such as Singapore, Mauritius, UAE, Luxembourg, Netherlands etc., not included in the list of jurisdictions – could be advantage Gift City

b. Category II FPIs not included

c. Foreign venture capital investors (‘FVCI’) not included

d. Holding companies, family offices / trusts. Individuals not included

4. Proposed valuation norms:

a. Rationale for multiple valuation methodology for non-resident investors not clarified, specifically for alignment with foreign direct investment (‘FDI’) regulations

b. Price matching and safe harbour are welcome reforms

c. Deeming fiction for ‘valuation date’ could create interpretation issues as to the year of taxability under Angel Tax provisions

Partner, Illume Advisory

yashesh@illumeadvisory.in

Partner, Illume Advisor

raashi@illumeadvisory.in